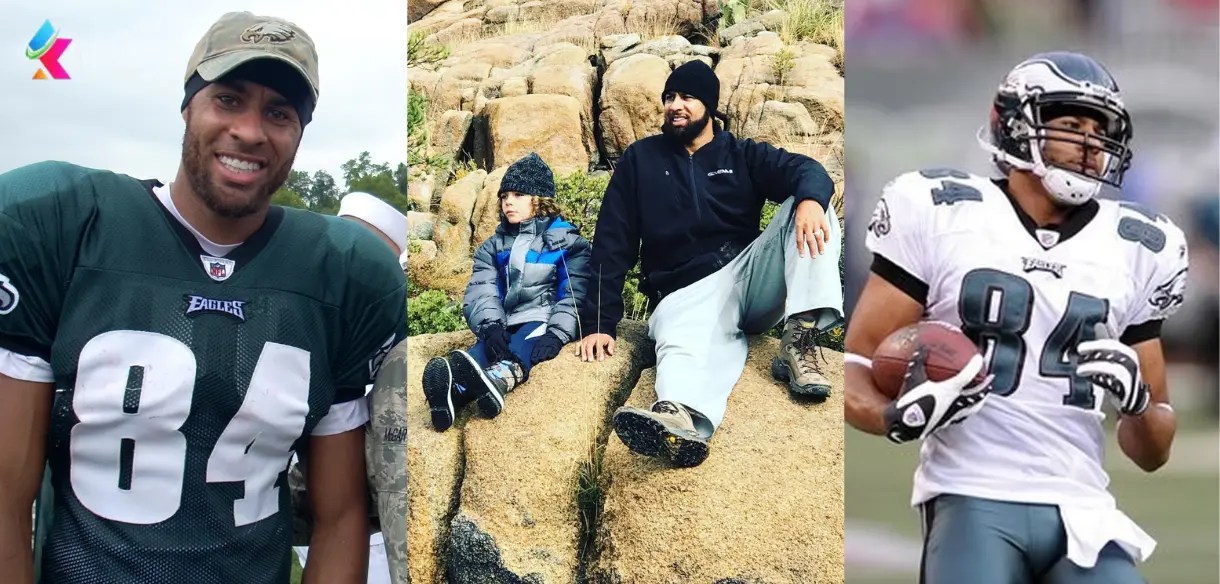

Hank Baskett net worth 2024 refers to the estimated value of the assets and wealth accumulated by American football wide receiver Hank Baskett by the year 2024. Determining an individual's net worth involves considering various factors, including their income, expenses, investments, and properties.

Calculating Hank Baskett's net worth in 2024 requires taking into account his earnings from his football career, including salaries, bonuses, and endorsements. Additionally, his post-retirement ventures, such as investments, business dealings, and any income-generating activities, would need to be factored in. Furthermore, his lifestyle, spending habits, and any debts or liabilities would also influence his overall net worth.

It's important to note that predicting an individual's net worth several years into the future involves a degree of uncertainty. Factors like market fluctuations, changes in investment strategies, and personal circumstances can all impact the accuracy of such projections. Nonetheless, understanding the concept of net worth and its various components can provide valuable insights into an individual's financial well-being.

Hank Baskett Net Worth 2024

Understanding Hank Baskett's projected net worth in 2024 requires examining key aspects related to his financial standing and wealth accumulation.

- Earnings: Salary, bonuses, endorsements

- Investments: Stocks, real estate, businesses

- Expenses: Lifestyle, taxes, debt

- Assets: Properties, vehicles, collectibles

- Liabilities: Loans, mortgages

- Market Trends: Economic conditions, investment performance

These aspects are interconnected and influence Baskett's overall net worth. His earnings and investments contribute to his wealth accumulation, while expenses and liabilities reduce it. Market trends can significantly impact the value of his assets and investments. By carefully managing these factors, Baskett can optimize his financial well-being and achieve his long-term financial goals.

1. Earnings

Earnings from salary, bonuses, and endorsements play a crucial role in determining Hank Baskett's net worth in 2024. These earnings represent a substantial portion of his overall income and directly contribute to his wealth accumulation.

As a professional football wide receiver, Baskett's salary is a significant source of income. His performance on the field, including statistics and achievements, can influence his salary negotiations and earnings. Bonuses, incentives, and endorsement deals further supplement his income, providing additional financial gains.

By maximizing his earnings through successful performance and strategic contract negotiations, Baskett can significantly increase his net worth in 2024. These earnings serve as the foundation for his financial growth and enable him to invest, save, and plan for his future.

2. Investments

Investments in stocks, real estate, and businesses are crucial components of Hank Baskett's net worth in 2024. These investments represent a strategic allocation of his wealth, aiming to generate passive income, appreciate in value over time, and diversify his portfolio.

Stocks, or equity investments, provide Baskett with ownership stakes in publicly traded companies. The performance of these companies, including their earnings, growth prospects, and market conditions, directly impacts the value of his stock investments. By carefully selecting stocks with strong fundamentals and growth potential, Baskett can potentially increase his wealth through capital appreciation and dividends.

Real estate investments offer Baskett tangible assets with the potential for rental income and long-term appreciation. Owning properties, whether residential or commercial, can provide a steady stream of passive income while also serving as a hedge against inflation. The value of real estate is influenced by factors such as location, property type, and market demand, and Baskett's investment decisions in this area can significantly impact his net worth.

Investing in businesses, either as an entrepreneur or through venture capital, allows Baskett to participate in the growth and success of various enterprises. These investments carry higher risks but also offer the potential for substantial returns. By identifying promising businesses with strong management teams and innovative ideas, Baskett can leverage his capital to generate additional wealth.

Effectively managing his investment portfolio, diversifying his assets, and staying informed about market trends are key to Baskett's financial success. Through strategic investments, he can maximize his net worth in 2024 and secure his financial future.

3. Expenses

Understanding the connection between expenses and Hank Baskett's net worth in 2024 requires examining how his spending, tax obligations, and debt impact his overall financial standing.

- Lifestyle expenses: Baskett's lifestyle choices, including his spending on housing, transportation, entertainment, and other personal expenses, directly affect his net worth. Maintaining a luxurious lifestyle with high expenses can reduce his savings and wealth accumulation. Conversely, adopting a more modest lifestyle with controlled spending can contribute to his financial growth.

- Taxes: Taxes are mandatory payments that individuals must make to the government, and Baskett's tax obligations impact his net worth. Depending on his income and deductions, he may have substantial tax liabilities that reduce his disposable income and, consequently, his net worth.

- Debt: Outstanding debts, such as mortgages, loans, and credit card balances, represent financial obligations that Baskett must fulfill. High levels of debt can strain his cash flow, limit his investment options, and negatively impact his net worth. Managing debt effectively, including timely payments and strategic repayment plans, is crucial for Baskett's financial well-being.

By carefully managing his expenses, fulfilling his tax obligations, and maintaining a prudent debt level, Baskett can optimize his financial position and positively influence his net worth in 2024. Striking a balance between enjoying a comfortable lifestyle, meeting financial responsibilities, and planning for the future is essential for his long-term financial success.

4. Assets

Understanding the relationship between assets and Hank Baskett's net worth in 2024 requires examining the various types of assets he owns and how they contribute to his overall financial standing.

- Real Estate: Properties, including residential and commercial buildings, land, and vacation homes, represent a significant portion of Baskett's assets. The value of real estate is influenced by factors such as location, property type, and market conditions. Appreciation in real estate value can contribute to Baskett's overall net worth growth.

- Vehicles: Cars, motorcycles, and other vehicles are depreciating assets but can still hold value depending on their rarity, condition, and demand. Baskett's collection of vehicles may include both everyday drivers and luxury or classic cars, which can impact his net worth.

- Collectibles: Items such as artwork, stamps, coins, and memorabilia can have significant value, especially if they are rare or in high demand. Baskett's collection of collectibles can contribute to his net worth, particularly if their value appreciates over time.

The value of Baskett's assets is subject to market fluctuations and economic conditions. However, by diversifying his asset portfolio and making strategic investments, he can potentially increase his net worth in 2024. Additionally, managing his assets effectively, including maintenance, insurance, and potential sales, is crucial for preserving their value and maximizing their contribution to his overall financial well-being.

5. Liabilities

Liabilities, including loans and mortgages, are financial obligations that can significantly impact Hank Baskett's net worth in 2024. Understanding the connection between liabilities and net worth is crucial for effective financial planning and wealth management.

Loans and mortgages represent borrowed funds that must be repaid with interest. These liabilities reduce Baskett's net worth because they represent a claim on his future income and assets. High levels of debt can limit his financial flexibility, restrict his investment options, and increase his overall financial risk.

Managing liabilities effectively is essential for Baskett to maintain a healthy net worth. This includes making timely payments, reducing debt balances, and avoiding excessive borrowing. By controlling his debt levels and making strategic financial decisions, Baskett can minimize the negative impact of liabilities on his overall financial well-being and work towards increasing his net worth in 2024.

6. Market Trends

The connection between market trends, economic conditions, and investment performance plays a crucial role in shaping Hank Baskett's net worth in 2024. Market trends encompass a wide range of factors that can significantly impact his wealth, including:

- Economic Growth: A strong economy with positive GDP growth, low unemployment, and stable inflation can create a favorable environment for businesses to thrive and investments to generate returns. A growing economy typically leads to higher corporate profits, increased consumer spending, and overall wealth creation, positively impacting Baskett's net worth.

- Interest Rates: Changes in interest rates set by central banks can influence the value of investments. Rising interest rates tend to make fixed-income investments more attractive, potentially leading to higher returns on bonds and other debt instruments. Conversely, falling interest rates may favor equity investments, as companies can borrow more cheaply and potentially increase their earnings.

- Inflation: Inflation, or the sustained increase in the general price level, can erode the value of investments over time. High inflation can reduce the purchasing power of returns and make it more challenging to maintain the real value of wealth. Baskett's investment strategy should consider inflation projections to mitigate its potential impact on his net worth.

- Stock Market Performance: The performance of stock markets is closely tied to economic conditions and investor sentiment. Bull markets, characterized by rising stock prices, can significantly boost the value of equity investments in Baskett's portfolio. Conversely, bear markets, with declining stock prices, can lead to losses and reduce his net worth.

By understanding and navigating these market trends, Baskett can make informed investment decisions, adjust his portfolio accordingly, and potentially maximize his net worth in 2024. Continuously monitoring economic data, analyzing market conditions, and seeking professional financial advice is crucial for navigating the complexities of the financial markets and achieving long-term wealth goals.

FAQs on Hank Baskett Net Worth 2024

This section addresses frequently asked questions regarding Hank Baskett's projected net worth in 2024, providing concise and informative answers to common queries.

Question 1: What factors influence Hank Baskett's net worth in 2024?

Hank Baskett's net worth in 2024 is influenced by various factors, including his earnings from football, investments, expenses, assets, liabilities, and market trends. His income, spending habits, investment strategies, and economic conditions all play a role in determining his overall financial standing.

Question 2: How do earnings contribute to Hank Baskett's net worth?

Earnings from salary, bonuses, and endorsements form a significant portion of Hank Baskett's net worth. His performance on the field, contract negotiations, and endorsement deals directly impact his income. Higher earnings allow him to increase his savings, invest, and accumulate wealth.

Question 3: What is the role of investments in Hank Baskett's net worth?

Investments in stocks, real estate, and businesses contribute to Hank Baskett's net worth by generating passive income and potentially appreciating in value. By diversifying his portfolio and making strategic investments, he aims to increase his wealth and secure his financial future.

Question 4: How do expenses impact Hank Baskett's net worth?

Expenses, including lifestyle choices, taxes, and debt obligations, reduce Hank Baskett's net worth. Managing expenses effectively, controlling spending, and minimizing debt can help him preserve his wealth and achieve financial goals.

Question 5: What is the significance of assets in Hank Baskett's net worth?

Assets such as properties, vehicles, and collectibles contribute positively to Hank Baskett's net worth. Their value can appreciate over time, further increasing his wealth. However, maintaining and managing assets also involve costs and potential liabilities.

Question 6: How do market trends affect Hank Baskett's net worth?

Market trends, including economic growth, interest rates, inflation, and stock market performance, influence Hank Baskett's net worth. A positive economic climate and favorable market conditions can boost his investments and increase his overall wealth, while adverse conditions may impact his financial standing.

Summary of key takeaways or final thought:

Understanding the factors that contribute to Hank Baskett's net worth in 2024 is crucial for assessing his financial well-being and wealth accumulation strategies. By carefully managing his earnings, investments, expenses, assets, and liabilities, he can optimize his financial position and work towards achieving his long-term financial goals.

Transition to the next article section:

Exploring the intricacies of Hank Baskett's net worth provides insights into the dynamics of wealth management and the factors that shape an individual's financial trajectory.

Tips for Building Wealth Like Hank Baskett

Understanding the strategies that contribute to Hank Baskett's net worth can provide valuable insights for building wealth. Here are some tips to consider:

Tip 1: Maximize Earnings

Negotiate a competitive salary, pursue bonuses and incentives, and explore additional income streams to increase your earnings potential.

Tip 2: Invest Wisely

Diversify your investment portfolio across stocks, real estate, and businesses to spread risk and potentially generate passive income.

Tip 3: Manage Expenses Prudently

Control spending, prioritize essential expenses, and avoid unnecessary debt to preserve your wealth.

Tip 4: Build Valuable Assets

Invest in appreciating assets such as real estate or collectibles that can increase your net worth over time.

Tip 5: Stay Informed About Market Trends

Monitor economic conditions, interest rates, and stock market performance to make informed investment decisions and adjust your financial strategy as needed.

Summary of key takeaways or benefits:

By implementing these tips, you can emulate the financial strategies of successful individuals like Hank Baskett, potentially increasing your wealth and securing your financial future.

Transition to the article's conclusion:

Building wealth requires a combination of smart financial decisions, calculated risks, and a commitment to long-term planning. By following these tips and learning from the experiences of those who have achieved financial success, you can work towards your own wealth-building goals.

Hank Baskett Net Worth 2024

Hank Baskett's projected net worth in 2024 serves as a valuable case study in wealth management and financial planning. By examining the various factors that contribute to his financial standing, we gain insights into the strategies that can lead to successful wealth accumulation.

Understanding the dynamics of earnings, investments, expenses, assets, and liabilities is crucial for managing personal finances effectively. Maximizing earnings through smart negotiations and strategic investments can significantly increase net worth. Prudent expense management, wise asset allocation, and staying informed about market trends are equally important for long-term financial success.

Building wealth requires a combination of financial discipline, calculated risks, and long-term planning. By emulating the strategies of successful individuals like Hank Baskett and implementing these tips, individuals can work towards their own financial goals and secure their financial future.

Article Recommendations

- Top Bobo Stats Trends 2024

- Mason Mccormick Steelers Rookie Impact Potential

- Drake London Catch Highlights Top Plays In London

![Hank Baskett Net Worth 2024 [Career, Wife, Age, Height]](https://i2.wp.com/visitinghub.com/wp-content/uploads/2024/01/Brown-Dust-2-Mod-Apk-2024-02-01T144803.968.jpg)